EDIT: Our own z1235 has posted a couple of months ago a reconciliation theory of Bitcoin and the Regression Theorem which is very similar to the one exposed below. Unfortunately I managed to miss that post in due time and was reminded of it only after publishing this.

The main idea: Bitcoin’s current rise to prominence will both mark the end of the use of Regression Theorem to discourage any alternative to the Gold Standard, and serve as the testbed of Hayek’s monetary insights.

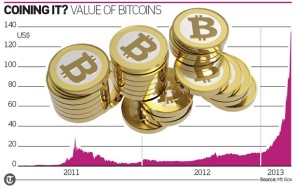

Let yours truly add his own two cents to the substantial analyses recently published on the great performance of Bitcoin (see here, here, here or here for a few Austrian perspectives), or specifically on what the its undeniable, if perhaps temporary, success may yet show to followers of the Austrian tradition.

1. Bitcoin for Misesians

1.1 Whether Bitcoin does or does not disprove Mises’ Regression Theorem has been discussed to some lengths, even right here (1 or 2) at our humble blog. My own position on the issue is quite close to Aristippus’: Bitcoin does not violate the Regression theorem because its current value it not monetary value.

1.2 To rephrase, Bitcoin is not a medium of exchange after all. Though the encrypted peer-to-peer protocol that is Bitcoin is generally considered an alternative currency, its actual use may be closer to a service: anonymous wealth transfers.

1.3 Let us suppose that, in this cash-strapped economy, Hogwarts tasks its bright students with the creation of a magic wallet. Such wallet will magically teleport whatever physical bill is placed inside into the corresponding wallet of a selected person, without leaving any trace whatsoever for third parties [1]. We would expect such wallets to sell for a price on the market, a hefty one even.

1.4 Still, would we consider such wallets themselves money? Certainly not. Instead, we would recognize the wallet as a service: anonymous cash transfers of actual money. Let me go out on a limb here and state that, to this day, Bitcoins have gained value mostly (only?) due their ability to transfer funds anonymously. Absent the encrypted nature of this protocol, the thing would most probably never have taken off. Indeed, had the creator(s) of Bitcoin called it a cash transfer service rather than a currency, no one (save a few astute observers) would have thought of it as of a (potential) currency.

1.5 But, though Bitcoin may not be money now, it can become so tomorrow. We may imagine a world where Bitcoins become so widely used as anonymous wealth-transferring protocols as to finally displace the actual fiat currencies that they transfer.

1.6 But should that day come, Austrians will be in no difficulty to explain Bitcoin’s value: it will have evolved from Bitcoin’s previous-day’s value as a commodity (or, in this case, service). Indeed, the higher the monetary demand for Bitcoin, the higher its price in terms of, initially dollars or whatnot, and potentially in goods, fully in line with the Regression Theorem.

1.7 But we are not allowed to say that the whole Bitcoin episode will bring nothing of value to the table for Austrians. Even if it should fail tomorrow, even should it be revealed as nothing but a bubble, Bitcoin will still have proved that the evolution from commodity to currency can be much, much shorter than implied by the Regression Theorem.

1.8 Indeed, if a few years may suffice for a completely new (and, as we saw in our [1] footnote, perhaps not so well-thought) service to evolve into actual money, than indeed the Regression Theorem remains unscathed (if not confirmed), but its polemical edge is shattered.

1.9 Tomorrow, there will be no novel monetary scheme which could be whisked away as impracticable by invoking the Theorem. If Bitcoin made it, any colorful commodity standard can make it too, and the Gold Standard is no longer the sole alternative to existing fiat currencies.

1.10 What Satoshi Nakamoto can say to Mises:

2. Bitcoin for Hayekians

2.1 Unlike Bitcoins, Hayek’s private fiat currencies, as explained in his Denationalization of Money: the Argument Refined (or see Robert Murphy’s oldish essay for a quick recap-with-critique), would rely on existing fiat currencies to gain their value, at least in the beginning. Still, just like Bitcoin, such private currencies too would start out as non-money but, in this case, financial derivatives, and supposedly work their way up from there.

2.2 The question that the Bitcoin experience will answer for the benefit of the sparse monetary Hayekians still around…

…will be whether an active managing party striving to stabilize the price (or, later on, purchasing power) of the currency-to-be is crucial to its success.

2.3 In this respect, the creator(s) of Bitcoin has/have, perhaps unwittingly, entered the fray of the great monetary debate: what is the optimal monetary supply? Satoshi Nakamoto sides with Rothbard: any supply, as long as it does not change, is optimal.

2.4 Bitcoins shall behave thus after 2140 when no new units shall supposedly ever be created again. Still, even until that date, the production (“mining”) rate of Bitcoins will be steadily decreasing, producing an approximation to the Gold Standard, with which the marginal cost of gold mining is constantly increasing.

2.5 And thus the question: if Bitcoin ever manages to become a monetary standard, will its users resent its inevitable deflationary tendency?

2.6 The answer cannot be given today as Bitcoins are not money yet, and it would thus be improper to speak of their meteoric price increase to day as of “massive deflation”. But if such a price increase does not turn out to be a bubble, and Bitcoin actually becomes money, we will surely be in a position to see whether it’s built-in deflationary nature[2] will hobble or aid it in the competition with alternative currencies. And just like that, a question of great import for those committed to monetary freedoms shall be answered.

2.7 But even should Bitcoins crash in the near future and not make it to currency status (incidentally bringing relatively great loses to this very blog’s humble finances), there will still be a lesson for Hayekians to salvage. Such a crash would fortify Hayek’s belief in the need for an active managing party to steer the currency’s value into stability.

2.8 Indeed, had Bitcoin 1) been redeemable from day one in any couple of well-known currencies, 2) backed by the necessary assets to inspire confidence in this pledge, and 3) been minable only by its issuers, and only to steer its value into stability, this experiment would have been quite different indeed. All may agree that Bitcoin’s well-known price fluctuations would, at the very least, been much more contained (again, see our [1] footnote to see the importance on stability).

2.9 Whether it is possible to produce a Hayekian stable currency and still have it retain Bitcoin’s encrypted peer-to-peer nature is of course debatable. But should Bitcons ever crash into oblivion, the next contender[3] will surely need to try. Throwing in a physical and aesthetically pleasing substitute for such Bitcoin 2.0 units (a piece of paper anonymously redeemable in virtual units, and vice versa) would also allay the fears of many who distrust ephemeral money.

2.10 What Satoshi Nakamoto can say to Hayek:

2.11 What Rothbard would say to Satoshi Nakamoto:

3.1 Bonus Track, what I would say to Satoshi Nakamoto:

Footnotes:

[1] exploiting the cheap labor of poor students has its drawbacks though, as our magic wallet almost randomly changes the amount of bills upon transfer, and the longer are the bills held into the wallet, the larger this random change. In this respect, Hayek would have produced a better version, but more on this latter.

[2] I am using the general, instead of Rothbardian, definition of deflation: a steady rise in purchasing power of money. The Hayekian definition is somewhat more detailed: a currency’s purchasing power is ‘stable’ if the chances of the future price of random good or service increasing or decreasing are the same. Price rises for random goods/services are more probable in deflation, and vice versa for inflation. As far as I know, Hayek didn’t succeed in translating this insightful definition of price stability into the mechanism of his private currencies, where he had to fall back on the commodity basket concept. Still, others may yet succeed.

[3] as Jeffrey Tucker’s exquisite article (linked at the every beginning) points out, e-money seems to be a textbook example of an interactive process where the previous failure leads to the next try. I may add that the network properties of money ensure that only one such iteration can be tried at any given time, and the better these trials get, the longer the time until failure.

[…] Bitcoins for Misesians and Hayekians (voluntaryistreader.wordpress.com) […]

[…] Euro experiment, undoubtedly the most salient monetary development of the last decade (not of the current one, though), for better or worse. To libertarians, the question of interest is such: was the adoption […]